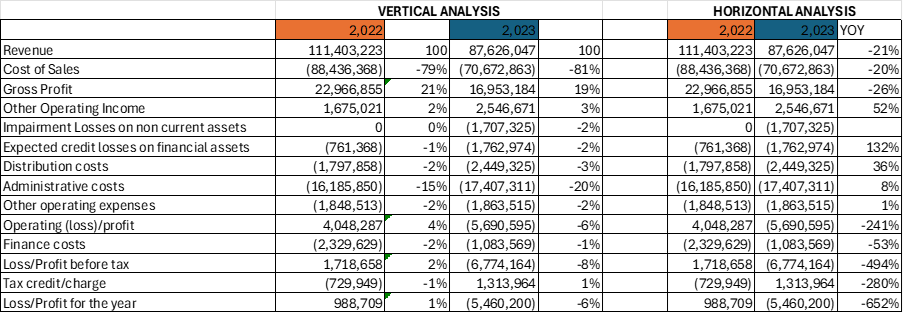

For the financial year ended June 2023, New Vision issued a profit warning and thus proceeded to post a loss of UGX 5.6 billion. The previous year, New Vision had posted a net profit of UGX 988 million. This implied a dip of 652%, it is this abnormality that ought to worry investors. Unless something catastrophic happens in a company, profits do not swing in this fashion. What could be killing New Vision?

In their annual report, New Vision indicated that 2023 was the fourth year of their five-year strategy. Will they return to profitability in the final year of their strategy? Did the strategy work? Was it a failure of strategy?

Before we give commentary, it’s important that we also bring to light a few facts:

- New Vision’s non-current assets of property, plant, and equipment (PPE) increased from UGX 34.4 billion to 44.4 billion

- Inventories increased from UGX 10.4Bn to UGX 21.4Bn.

- Receivables reduced from UGX 132.8Bn to 26.9Bn

- Payables increased from UGX 11.2Bn to UGX 38.2Bn

- Cash from operations increased from UGX 5.2Bn to UGX21.2Bn

- Cash paid for PPE increased from UGX 4.3Bn to UGX 12.4Bn

- Cash and cash equivalents reduced from UGX 2.5Bn to UGX 2.2Bn

- New Vision closed the year with Work in Progress equivalent to UGX 10 Bn

Although it would have given more detail to work out the financial ratios of New Vision (profitability, liquidity etc), in this context, there would be no loss in generality from not doing so. There are some glaring facts that New Vision ought to address if it is to return to profitability.

First, it would be important to understand what kind of projects New Vision is pursuing. What is this UGX 10 Bn Work in Progress? What was the rationale of pursuing those projects? Are they strategic projects? New Vision’s Capital Expenditure (CAPEX) Strategy should be reviewed as soon as possible. For a company that generated more cash from operations, only to use the same cash in the purchase of PPE. For a firm dealing with economic downturns, an efficient hold on cash would make sense and the Capex plan would have to be reprioritized. Why for example is New Vision holding to motor vehicles and cycles? Why not lease them? Why not benchmark other organizations in this aspect?

Secondly, there’s an issue of the inventory. Why would New Vision keep commercial paper of UGX 5.1 Bn and publishing stock jumping from UGX 2.1Bn to UGX 10.2 Bn. This is an urgent matter to be addressed. What’s New Visions inventory strategy? For a company whose publishing revenue has fallen from UGX 26Bn to UGX 7.5Bn, there’s no justification for holding this much inventory.

The other contradiction is the reduction in receivables and a jump in payables. How will New Vision clear payables that have since more than doubled from UGX 11.2Bn to UGX 38.2Bn? If the plan is to jump to profitability in 2024, then this is a number that will haunt New Vision in 2024.

Other areas to address are the cost of sales, and the expected credit losses. In brief, none of New Vision’s numbers paints a possibility of returning to profitability. It would take buckets of creative accounting for New Vision to register a profit in 2024.

For National Social Security Fund that holds a 19.61% stake in the company, it should consider reducing this shareholding. Yes, New Vision may return to profitability, but that could take another 3 to 4 years. With a board that’s tied up with other commitments, with an average age of board at 53 years, it would be the most magical turnaround in Ugandan corporate history. However, we could trust in the miracle of the innovation and diversification that has been mentioned as the weapon for a return to profitability.

For the full outlook on New Vision’s return to profitability, reach out to ortegagrouplimited@gmail.com or visit www.ortegagroupug.com